The Potential for Growth: Two Case Studies

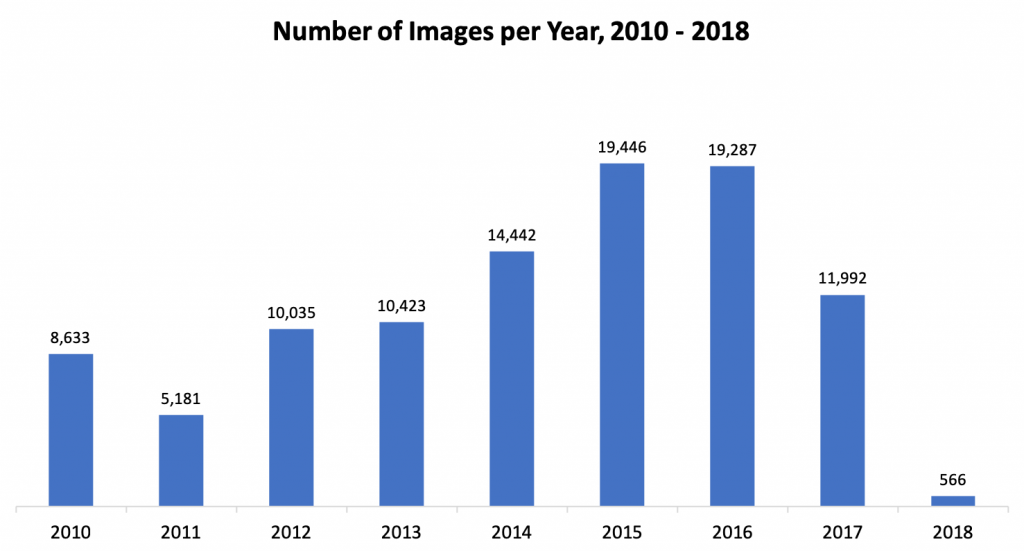

Suppose you have $2,000 today to invest. You use that money to purchase a low-cost, tax-efficient, diversified mutual fund offering a yearly return of 6%. You purchase the mutual fund on your 22nd birthday and don’t check your account until your 65th birthday on the day of retirement. After 43 years, you would have over $26,200! Your money has doubled four times.

Now suppose you again have $2,000 to invest. You purchase shares of the same mutual fund. Now, in addition to the initial investment, you purchase $100 of additional shares each month. How much would you have at the end of 43 years? Over $268,400! You have passively created wealth through the market.

Check out this interactive tool for a visual representation of these two cases.

Vision & Goals

Investing is not an end in itself; it is a means of reaching your financial and personal goals. The most common investing goal is saving for a comfortable retirement. You can invest for other goals too: a home down-payment, children’s college, travel, future medical care, or a car.

My personal vision to have enough saved and invested by the age of 45 to have a monthly income of $6,000 from my investments. It won’t come easy: I’ll need to have saved and invested $1,139,000 by then!

Before You Invest

Before you start pouring money into any investment, step back and make sure the rest of your financial life is in order.

First, reduce or eliminate debt. Does it make sense to earn 6% annually on an investment when you pay 24% annually for credit cards or other forms of debt? Second, create an emergency fund worth 3-6 months of expenses. Unexpected events can be stressful and costly. Emergencies take many shapes and sizes such as job loss, medical or dental emergency, unexpected home repairs, or car troubles.

Big Picture

There’s so much investing advice on the internet that it can be hard to condense it all into a few core principles.

The following phrase encapsulates my investing philosophy and serves as a reminder of four fundamentals of investing:

I will pursue low-cost, tax-efficient investments that form a diversified, long-term portfolio.

1. Low-Cost: The Expense Ratio

The cost of an investment largely depends on whether it’s actively or passively managed. Some people are willing to pay a financial advisor an expense ratio of 1-3% to actively manage their investments. Passively managed funds, like index funds that are determined by a computer, are much cheaper. Look for funds (investments) with expenses ratios in the range of .1 to .3%. This means you’re paying between $1 and $3 for every $1,000 invested. Don’t let your returns be eaten up by fees!

2. Tax-Efficient: Roth vs. Traditional IRA

Tax breaks are a way for the government to incentivize “desirable” behavior. For example, the IRS will let you deduct mortgage loan interest when filing taxes because they’d like to reward home ownership. Because the government also wants you to save for retirement, there are “tax-sheltered” investment vehicles that reward you for saving.

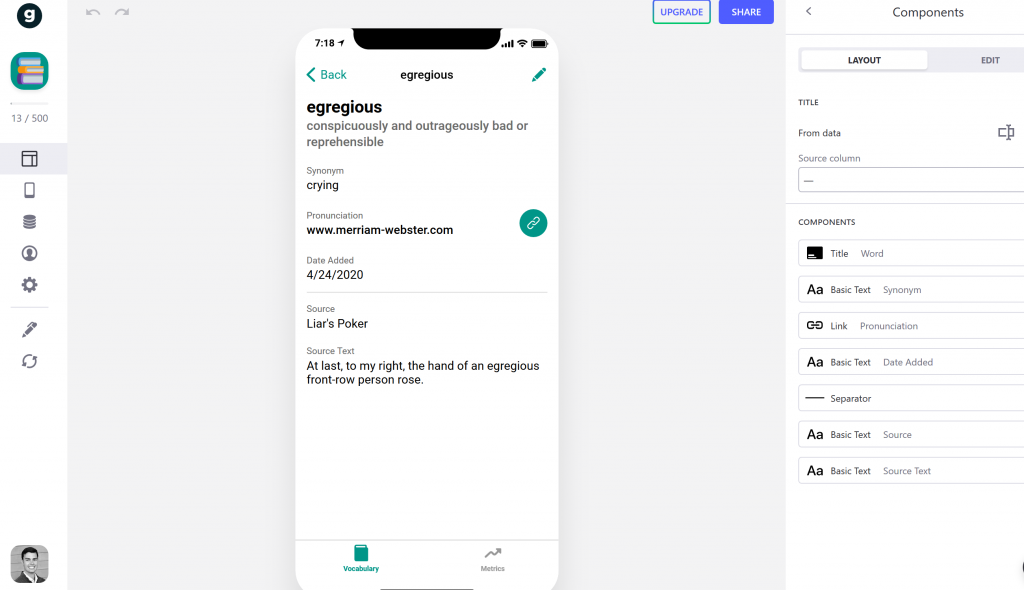

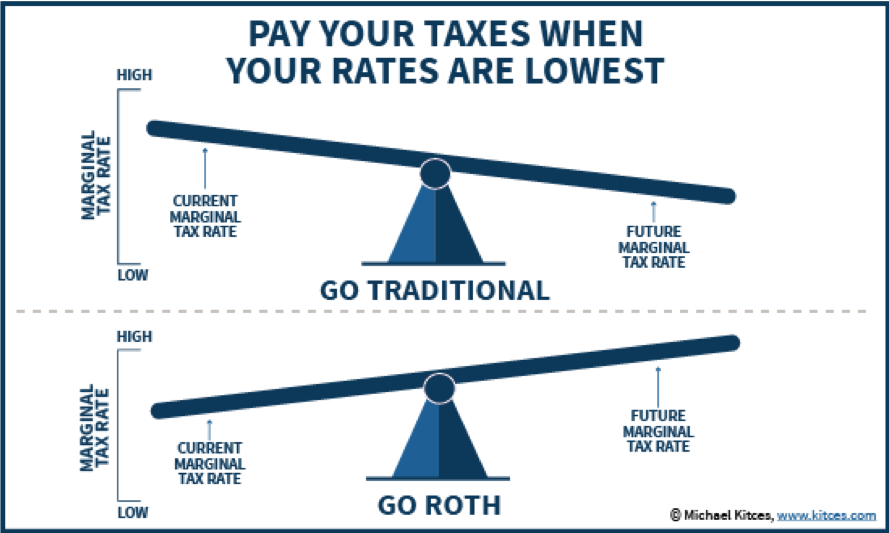

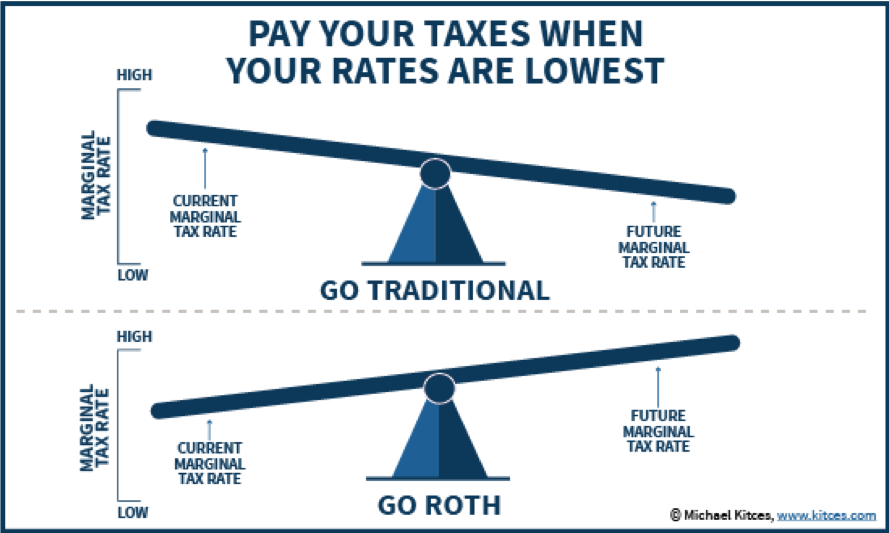

While there are many types of investment vehicles, two kinds to be aware of are the Roth and Traditional IRA (Individual Retirement Account). The image below shows the key difference between the two:

The questions becomes, which is best for me? I use a Roth IRA because I anticipate having a low marginal tax rate when I’m young (when I’m relatively poor) and a high marginal tax rate when I retire (when I hope to be more wealthy). Another diagram for clarification:

3. Diversified: Asset Classes

Diversification is your best defense against risk. To be diversified you should invest in different companies, industries, and perhaps even countries that won’t be subject to the same economic factors or risks. This is easily achieved by purchasing a mutual fund that consists of hundreds of companies!

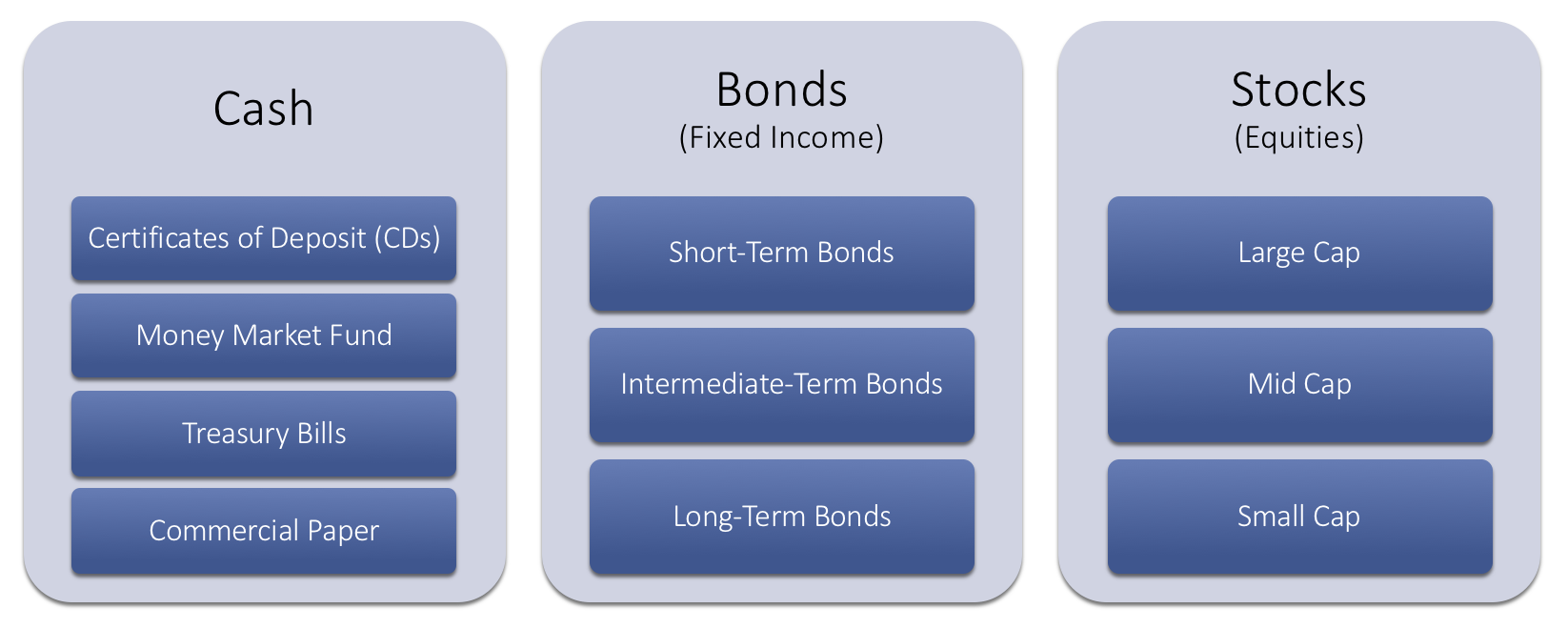

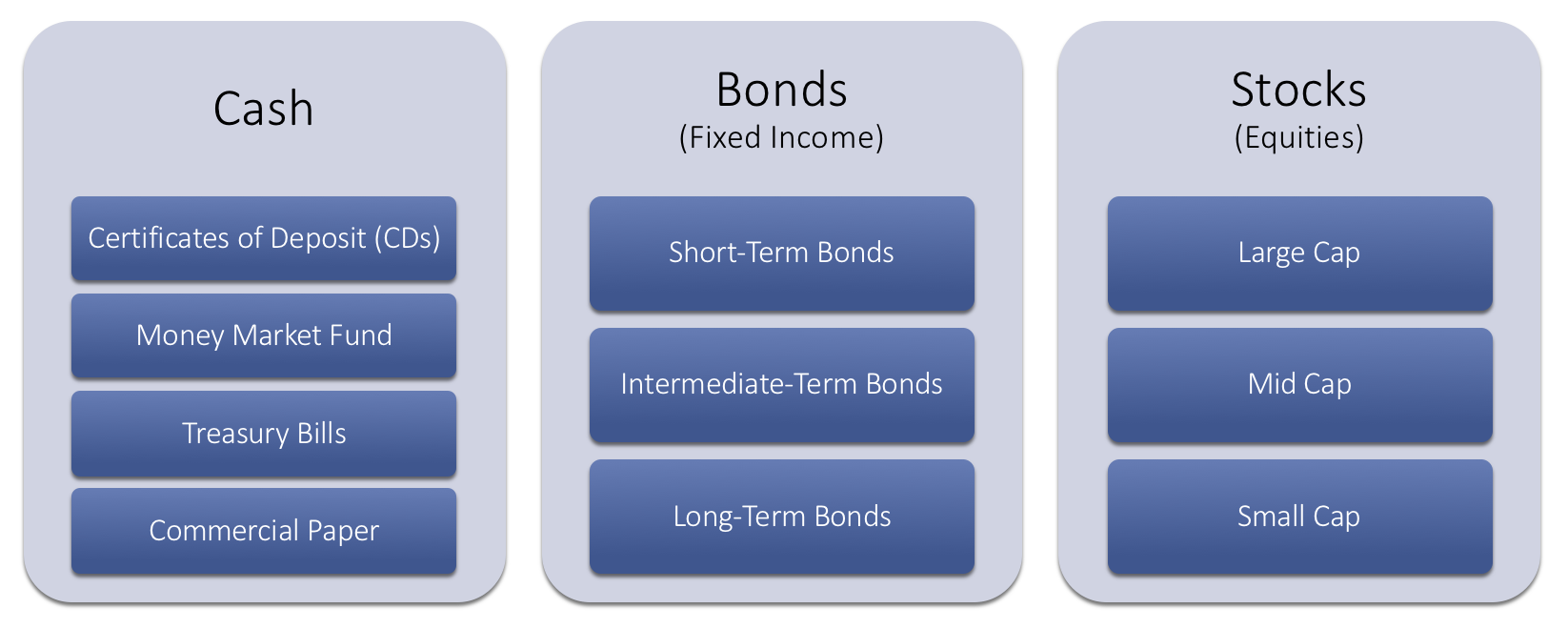

It’s good to be aware that there are several broad categories of assets: cash (and cash equivalents), bonds, and stocks. Diversification usually involves investing in some assets from each category.

4. Long-Term: Passive Approach

Invest for the long run; use a buy-and-hold strategy! There are no “get-rich-quick” schemes that work. Avoid short-term trading. Short-term trading is expensive and incurs transaction costs and taxes. Plan for a time-horizon of 40+ years. Dips and fluctuations in the market will even out over time.

Remember: I will pursue low-cost, tax-efficient investments that form a diversified, long-term portfolio.

Specific Fund Suggestion

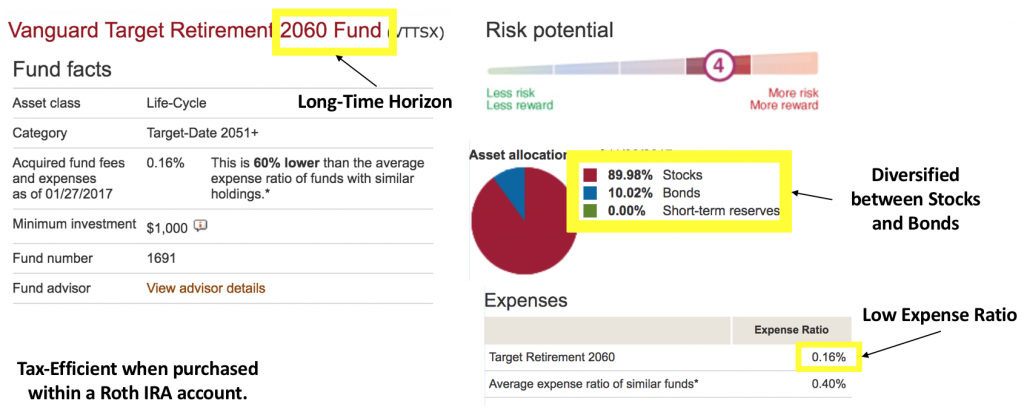

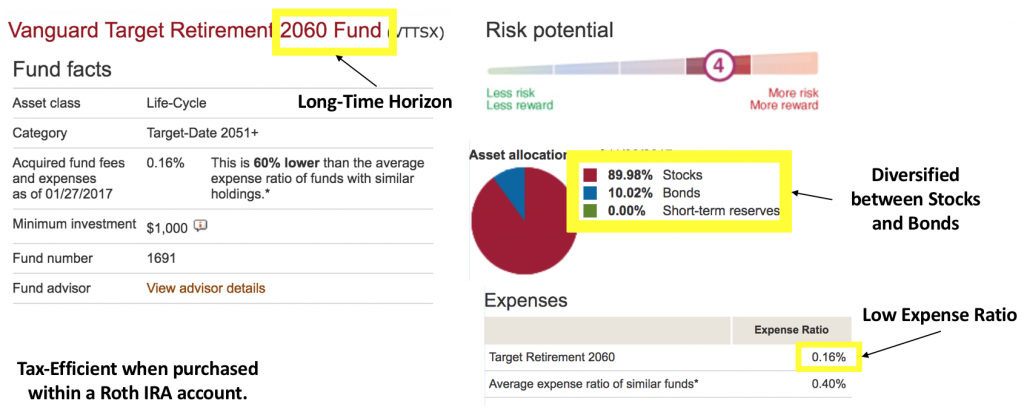

To conclude, here’s a specific example of what to look for when considering an investment. VTTSX is a Vanguard mutual fund with a low expense ratio that automatically adjusts asset allocation as you approach retirement. With 42 years until 2060, this fund is currently mostly made up of stocks, which have higher risk but offer a greater return. As the target date approaches, the fund will swap stocks for bonds to lower the overall risk. The only downside of this fund is the minimum investment threshold, which is $1,000.

Key Terms to Understand

Investing: the act of committing money to an endeavor (a business, project, real estate, etc.) with the expectation of obtaining an additional income or profit. Investing refers to long-term commitment, as opposed to trading or speculating, which are short-term; it is not a get-rich-quick scheme. You can make an investment at a bank, broker, or insurance company.

Asset: A resource with economic value. There are many kinds of assets. Some examples: shares of Apple stock, a US Treasury Bill, a foreign currency such as the Peso, or Coca Cola’s Coke formula, or a mall parking lot.

Asset Class: Categories of assets (investments) that are similar in risk, volatility, and return. The major asset classes are cash and cash equivalents, fixed income (bonds), and equities (stocks). Successful investing largely depends on asset class, rather than asset, selection.

Portfolio: The collection of assets held by an investor. For example, suppose an investor owns $250 worth of US T-bills and $750 worth of Google stock. We would say that this investors portfolio contains 25% bonds and 75% stocks.

Diversification: Investors reduce risk by building a portfolio with different asset classes. For example, rather than buying only stocks, wise investors will also purchase bonds, which tend to perform well when stocks perform poorly.

Return: Different types of investments post different rates of returns. Investments make a return by providing the investor interest, dividends, or capital gains. Returns are the gain or loss generated on an investment and are usually expressed as a percentage. A typical annual return on a moderately aggressive portfolio might range from 7-9%.

Expense Ratio: Institutions (banks, brokers) charge a fee for you to invest. The expense ratio represents the percentage of assets deducted each fiscal year for fund expenses. For example, one Vanguard Mutual fund has an expense ratio of 0.15%. This means It costs $1.5 to invest $1,000.

Mutual Fund: Mutual funds give small investors access to professionally managed portfolios of equities, bonds and other securities. Mutual funds are a great choice for early investors.

Disclaimer: This information is intended for an audience of emerging investors and does not constitute professional advice.